We tend to overconsume things that have no monetary cost.

In economics, we call this the “free rider problem” where consumers do not value the inherent costs and benefits of things that are free.

Think about it yourself, what is the cost of the street you live on, or the streetlamps that light them in night-time hours?

It’s hard to ascribe a value because they’re free to use – sure we pay for them in other ways – but we don’t know the specific dollar cost.

This is the same with financial markets brokerage costs.

$0 Brokerage

When Robinhood came into existence, it wasn’t charging commissions on trading and many were critical of their business model – how would they make money?

But then they opened millions of new accounts and their competitors lost business hand over fist, which caused them to lower their own commissions in order to compete.

We saw this happen in 2019 when TD Ameritrade and Charles Schwab – two large US retail equity brokers – lowered their commissions to $zero.

At this point, it is worth mentioning that for retail equity brokers, commissions are only a small part of their revenue. A large portion of an online broker’s revenue comes from net interest on deposits (that’s gone now with 0% cash rates), securities lending fees (they take a margin in lending equities to short sellers), margin on derivative users and to a lesser extent, revenue from larger, institutional prime brokers for their order flow.

This last point is the most interesting as Robinhood isn’t executing the trades you place through their platform into the market, they’re outsourcing these orders to third parties (i.e. Citadel), who are remunerating them for this business.

As an investor, Robinhood sounded like a great deal, unless one also weighs the behavioural impacts of free commissions.

Enter /r/wallstreetbets

Like a flash mob from the 00’s, the subreddit of r/WallStreetBets utilised the free commissions en masse, buying stocks like GameStop (NYSX:GME) and other heavily shorted US equities.

This retail trading quickly became international news as GameStop shot up 1914% in a 10-day period.

Let us be clear – none of this would’ve happened if trading commissions were higher, say $10 USD or more.

These WallStreetBet members were buying single or even fractional shares (less than 1 share), which wouldn’t have made economic sense if brokerage was a factor.

Take, for example, buying a single share of GME at $5/share when the brokerage is $8?

This wouldn’t happen. The stock would need to rally 160% before you made any gains, and then you’d need to factor in another $8 cost to sell, requiring at least +320% returns to break-even.

As a second order effect, it would’ve been unlikely to see such rapid-fire trading to drive the stock price up so quickly towards $500 USD/share.

Fast Markets

One thing that we need to be aware of is that financial markets react far faster in the current technological, internet age than they ever have before.

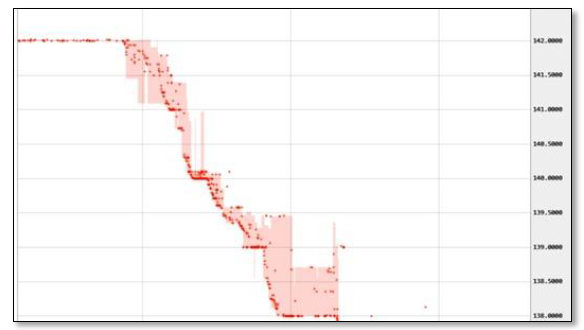

The below chart is a random 400 milliseconds sample of trading that took place on 25-Jan-2021.

What you should glean from this is that the stock rallied over 2% in the “amount of time it takes your visual cortex to form an image from your retina.”

No one can make a trading decision this quickly to buy into that speed-of-light 2% rally.

This was a LOT of people putting through trades at similar times, all to buy, and the price popped upwards!

Behavioural Economics

Coming back to my original premise, retail investors wouldn’t trade as quickly and frequently if they had to pay commissions, which is an opportunity for investor education.

Investing involves risk – often considerable risk – that is not easily understood and probably not well-enough understood by the echelons of young retail investors who are trying to bank profits over single stock purchases to buy chicken tenders (“tendies”). Not kidding, it’s quite a funny meme.

This investment education opportunity is there for those able to teach the newest generation of investors, Millennials, personal finance skills, valuation, buy-and-hold strategies and thematic investing. Trading may also have its place as a form of risk management, but day-trading stocks is likely a short term aberration for a few, rather than a viable long-term strategy to ascertain “A Millie”.

Looking Back to Look Forward

George Santayana wrote in The Life of Reason: Phases of Human Progress (1905-1906) that

“Those who cannot remember the past are condemned to repeat it.”

This phrase will likely remain relevant for our entire lifetime, and in this instance, has the obvious analogue to the dot-com bubble of 1999, where retail exuberance in the US stock market preceded the NASDAQ’s 80% decline in a violent bear market.

However, this time is different in some respects, r/WallStreetBet “Redditors” are not all trying to make money, many are trying to break the system where the current form of capitalism is the enemy.

This doesn’t mean the end is nigh, as John Maynard Keynes famously quipped, “markets can remain irrational longer than you can remain solvent.”

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.