“People say I got a drinkin’ problem

But I got no problem drinkin’ at all

They keep on talkin’

Drawing conclusions

They call it a problem, I call it a solution”

Midland (2017)

My song and band reference may be unknown to you today, a modern country music band from Dripping Springs, Texas. My wife and I saw Midland when they were touring Australia last October, and they put on an amazing performance.

The song I chose is a tongue-in-cheek appropriation of alcoholism to the financial market’s need for liquidity to stay buoyant – a topic that needs to be discussed.

Asset prices are a function of liquidity

Asset prices are a function of liquidity

Asset prices are a function of liquidity

Asset prices are a function of liquidity

One of the first things I learnt when managing money is that liquidity shapes nearly all investment decisions.

When I say liquidity, I mean our ability to buy or sell a financial asset in a timely manner, without seeing a large change in price. I.e. if I try to sell $10k worth of BHP I can be in/out in a matter of seconds. But, if I try to sell $50mln worth, I may see a big swing in price if I want to be in/out in the same time frame.

Likewise, I may be able to trade in/out for a small change in price, if I’m willing to take a longer time to buy/sell.

The asset prices that we buy and sell at, are a function of their current or perceived liquidity.

Druckenmiller on liquidity

The following quote is from a Barron’s magazine interview of Stanley Druckenmiller in 1988. Druckenmiller is widely regarded as one of the most successful investors of all time, having run Quantum Fund with George Soros and then his own Duquesne Capital.

“Contrary to what a lot of the financial press has stated, looking at the great bull markets of this century, the best environment for stocks is a very dull, slow economy that the Federal Reserve is trying to get going… Once an economy reaches a certain level of acceleration… the Fed is no longer with you… The Fed, instead of trying to get the economy moving, reverts to acting like the central bankers they are and starts worrying about inflation and things getting too hot.”

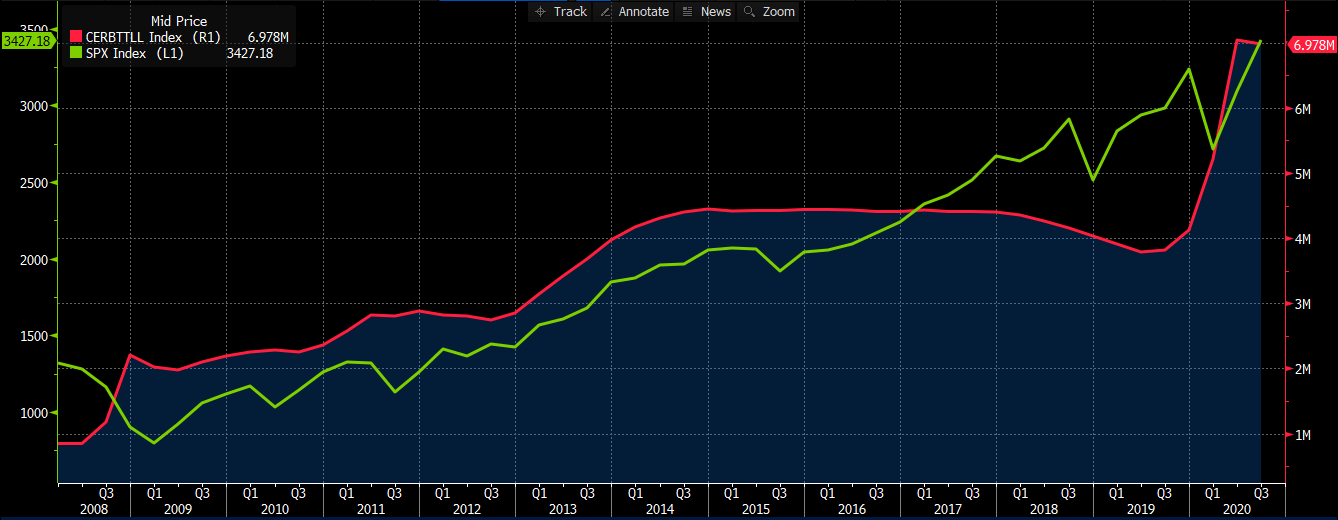

To emphasise my point, the below chart depicts the relationship between the S&P 500 equity index (green) versus the Federal Reserve’s balance sheet (red). As the Fed’s liabilities (cash at bank) have grown since 2008 through quantitative easing (QE), the US stock market has broadly rallied inline with the quantum of money supply increases.

Source: Bloomberg

Asset price volatility is a function of liquidity

Going one step further, asset price changes (realised volatility) are also a function of changes in liquidity.

Add liquidity, volatility goes down.

Remove liquidity, volatility goes up.

This is a simple formula that is very general, but the “rule” has held consistently for 32 years since Druckenmiller mentioned it in the mainstream news.

This is what makes it harder for risk assets (such as equities and corporate bonds) to underperform when liquidity remains abundant.

Wall of money

If we take a step back, we should mention that central banks such as the Federal Reserve and RBA are NOT targeting equity markets explicitly through their policy toolkit, but are seeking to avoid a credit crunch similar to the Great Depression or the 2007 portion of the GFC.

These central banks are seeking to return markets to this “dull” environment that Druckenmiller mentions, ideal for economic prosperity and achieving central bank policy targets.

In both the Great Depression and 2007, before the Fed stepped in with QE in 2008, both periods were marked with severe credit market stress, where everyday companies were unable to seek funds to continue normal operations. This was far-reaching as banks were not paying one another for every-day personal transactions, nor were they financing small and larger businesses to continue operations or grow them.

Without credit, the economy stalls to a halt.

This is why the Fed and other central banks are adding liquidity through increased “open market operations” and QE so that the economy can continue to function at a basic level. This then allows more complex forms of financing – such as equity capital markets – to function at other levels, and keep the system ticking over.

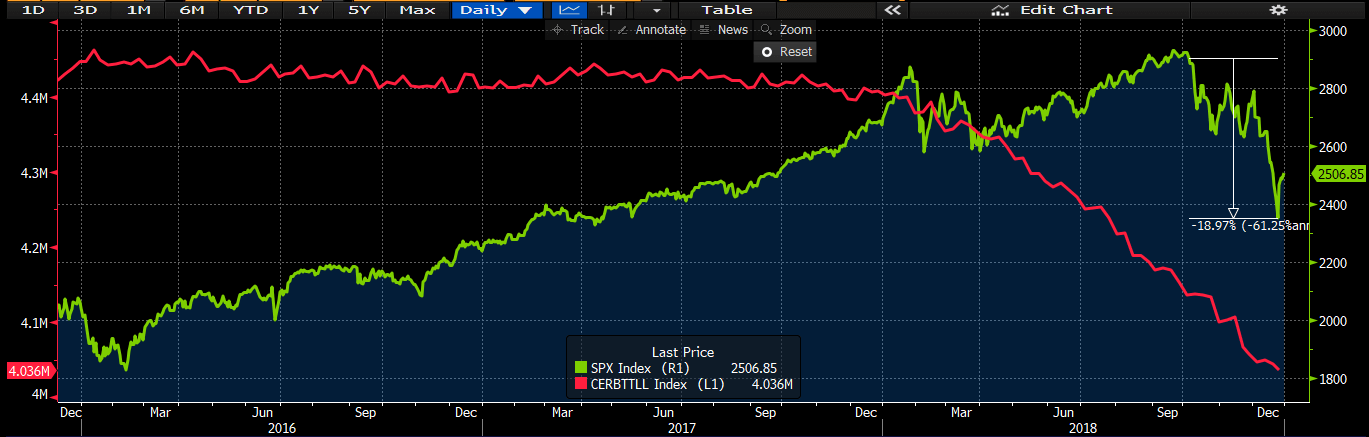

I highlight the Federal Reserves removal of liquidity through actively reducing their balance sheet size in 2018 (by selling their bond holdings), which was a withdrawal of market liquidity and catalyst for the 19% sell-off in the S&P 500 in Q4 2018.

This was the first reduction in the Fed’s balance sheet since 2008 and saw their asset book reduce from 4.45 trillion USD to 4.0 trillion.

Again, charting S&P 500 (green) vs the Fed’s balance sheet (red) for this 2016-2019 period below, note the large drop in the S&P with a small lag to the Fed’s balance sheet contraction.

Source: Bloomberg

We are seeing this in Australia as well.

Our very own RBA’s QE has seen a large increase in cash held at the central bank, which has been buoyant for asset prices, which are not reflecting that we are in a severe recession right now. If they were, global financial markets would not be near or at all-time highs.

This correlation isn’t quite as strong in Australia as the RBA’s QE has seen funds impacting our domestic bonds markets more than equity markets, but the relationship is still strong.

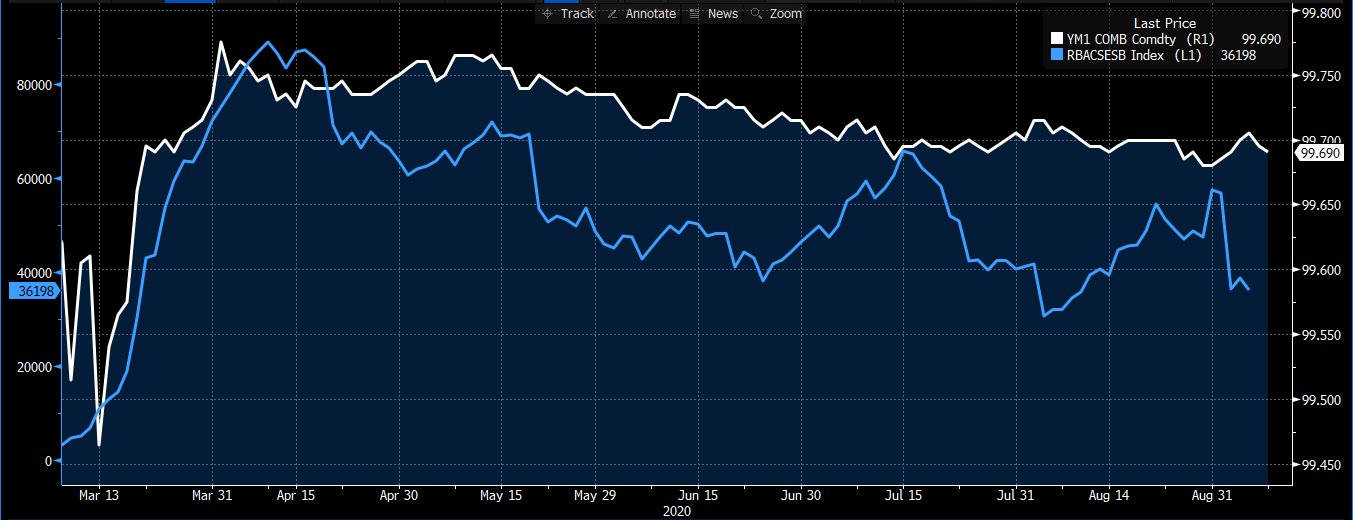

Below, I chart the RBA balance sheet (blue) compared to our 3y government bond (ASX listed futures contract, white). When the RBA transacted most of their 50bio of QE in March/April, the 3y government bond (and the ASX future) rallied in-line.

Source: Bloomberg

Tying this all together

If we can establish that asset prices are reflective of underlying liquidity that is structurally supported by central banks’ monetary policy operations and liquidity facilities, then it’s much more difficult to meaningfully foresee a move lower in asset prices (think bonds, equities or even real estate), without a change in liquidity and/or market sentiment.

In Australia, this means there is a structural demand of new bond issuance, aka primary bond transactions.

We have – and will continue to see – this as primary bond issues are 3-5 times oversubscribed, and the majority of new deals rally in the secondary market as well.

An example: our Commonwealth government issued a record 21bln AUD of a new 10y bond two weeks ago, having attracted over 65bln of bids.

Just yesterday Jemema Gas issued 350mln AUD of bonds, having received approximately 1.4bln of bids.

Whilst over in the USA, there is a slightly stronger correlation to equity market performance, especially the large-cap stocks, which continue to outperform.

In 1970, Martin Zweig coined the phrase “Don’t fight the Fed” in his book Winning On Wall Street, where he talks about the importance of monetary policy to stock market returns, as well as interest rate movements. That phrase is as true now as it was 50 years ago, as investors are forced to ignore valuations and go with the direction central banks are directing us.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.