I’ve wrote the majority of this note on 2-October and since original time of writing, it has been reported that US President Trump and his wife have tested positive for COVID-19 and have begun their 14-day quarantine period.

It would be impractical to cover the possible financial market reactions and possible health outcomes for the Trump household in this note – and updates will be frequent and evolving over the coming days and weeks – as we further understand what this means for the upcoming US election.

I’ve written the below regarding the US election as it stands on 2-October, with the individual holding the US Presidency having less relevance for financial markets than the majorities in both Houses of Congress. Please enjoy, and we will continue to update our views over the coming days/weeks as opinion becomes fact.

The USA is holding their presidential election on Tuesday, 3rd of November – slightly less than a month away.

The election has global ramifications as the US accounts for about 25% of global aggregate GDP growth and therefore US growth prospects matter for global growth simply by arithmetic.

A cohesive strategy among the President, House and Senate has potential to affect US growth and global prospects overall, as well by industry sector through the economic channels of investment, trade, consumption and financial markets.

For us in APAC, the most important geopolitical issue is wrapped up in the election is how US and Chinese tensions evolve post the election.

Asia is arguably the largest economic beneficiary of globalisation, which is in the process of being partially undone and disrupted by more protectionist policies, particularly hawkish US policy towards China.

Therefore, it’s possible that a Joe Biden (Democrat) win of the US presidency may be more positive for Asia than a 2nd four-year term of Donald Trump (Republican).

In general, the outcomes of the election are too convoluted and complex to lend themselves to any binary output i.e. “if X happens, then Y asset will respond in Z manner”.

As well, financial markets have not been great gauges for election probabilities, as 2016 has taught us. However, I still think a market “rule of thumb” should be that when chaos is expected, a lack of chaos will ensue (think of Y2K).

The one thing that everyone should be aware of is that there may not be a clear-cut winner on the night of the election, and we may see several days or weeks of delays until a clear-winner is determined, certainly if mail-in votes are to be counted.

It should be noted that several “swing” states such as Pennsylvania, Michigan and Wisconsin do not allow ballot-counting to begin until election day, which may delay results, especially from key battleground states.

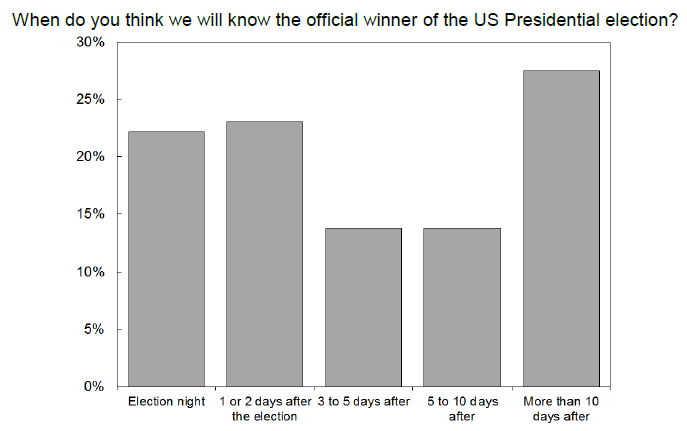

HSBC conducted a survey of when fund managers (myself included) would expect the election result, with fund managers highlighting more than 50% chance we’ll get the outcome at least 3 days after November 3rd.

Source: HSBC

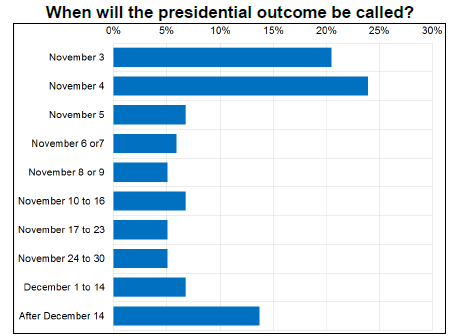

A poll from PredictIT.org has an even longer delay in an outcome/result forecast.

Source: Predictit.org

As I noted, the outcomes for financial markets from this election are complex, multi-faceted and nuanced; however, I have tried to add insight into how several global markets may react.

US Equities

When speaking to advisors and fund managers across Australia, there is a clear association of candidate Biden with a sell-off in the S&P 500 index.

So far, this has been anything but the case, as Biden is better associated with possible US fiscal stimulus through government expenditure, which is more beneficial for US equity markets in the short to medium term.

More fiscal expenditure and a higher velocity of money is beneficial for liquidity, which is associated with future price gains in US equities.

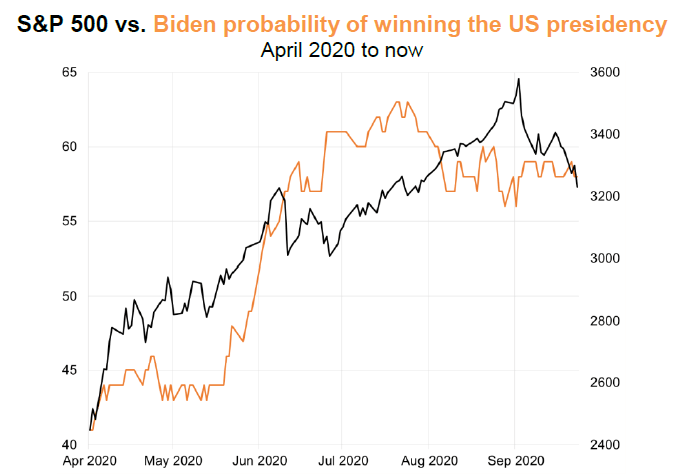

If Biden was negative for stocks, his probability of winning would not be as correlated with the performance of the S&P 500, shown below. Correlation does not mean causality, but there is a link.

Source: Bloomberg, HSBC

Further, there is ongoing debate as to which political party is better for the stock market.

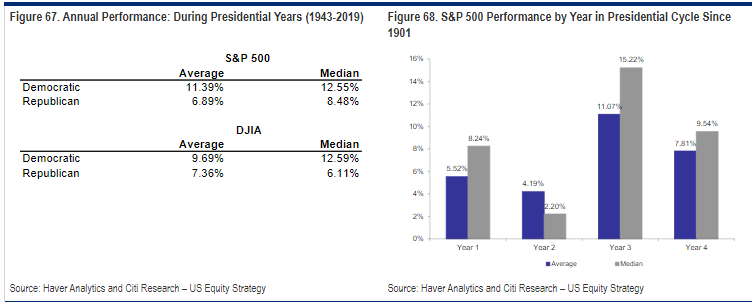

The below chart from Citi shows that on average, Democrat presidential years have been a clear boon to US stocks, especially so in the 3rd and 4th years of the presidential term.

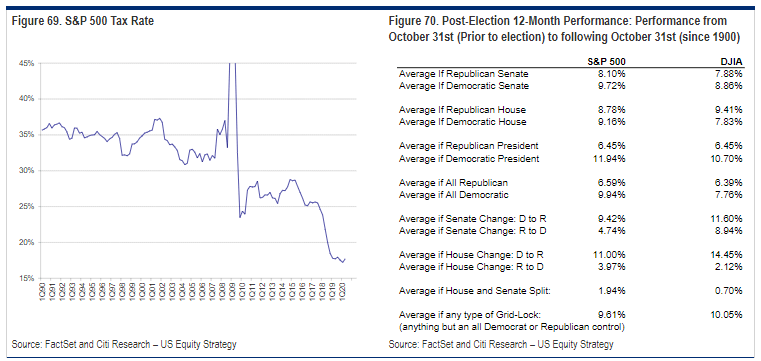

While who occupies the White House is important, the real key is Congress. The best outcomes for US equities are when all three branches of government – the President, House and Senate – all lean the same direction, or at least the House and Senate. The below table from Citi shows the outperformance of the S&P500 when both House and Senate have a same-party majority.

On a broader note, a democratic majority in both the House and Senate would translate into higher taxes for richer Americans and corporations with the key issue being capital gains treatment.

A meaningful adjustment to ordinary income tax levels (as opposed to the controversial “wealth tax” proposal) would be considered market unfriendly in the near term, as investors lock in gains at the lower (current) tax rate, and there may be a sell-off in stocks that have rallied (harvesting capital gains).

Conversely, a Trump re-election would defer any tax increases.

Under a Trump victory, sectors such as energy, banks and defence would likely fare better, whereas export/import trade-related names may fare worse due to trade/tariff uncertainty.

More specifically, US financial stocks remain the largest component of the US “value” index, representing more than 20% of the index. They would likely need higher nominal 10-year bond yields and a steeper yield curve to see higher revenues and net interest margins (NIM), which central banks are suppressing for now. As such, I can see value in cyclicals where there is a historic relationship with inflation expectations and outperformance verses defensive names.

Fixed Income

A clean result is the most important outcome for fixed income markets rather than who wins the Presidency.

One thing we learned from the 2000 Gore-Bush election was that fixed income markets do not like contested results or protracted outcomes.

The 2000 US election took place on November 7th and the result was not known for 36 days, December 12th, where the US Supreme Court settled the recount dispute in Florida, and Bush winning by a single electoral college vote.

During this period, US bonds rallied, as an example, US 10y treasuries moved dramatically during this period rallying from 5.8% to 5.0% (a 14.66% move), after barely moving all year.

Source: Bloomberg

This year could be more important than 2000, given the need for critical decision making in regard to the COVID-19 pandemic, reopening of the economy, vaccines and coordination with US States and their respective governors.

Fixed income markets are more concerned about stability than growth, and as such the rates market will have queries and concern for the US fiscal stimulus situation.

The original CARES Act was bipartisan; however, subsequent stimulus bills have been in limbo as the two major parties can’t agree on size and composition of the next package.

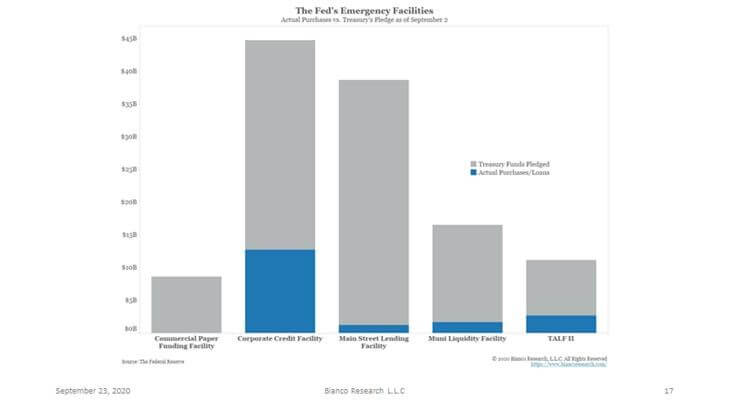

With conventional monetary policy largely exhausted, central banks may need to resort to more esoteric and unconventional policy – though in the Fed’s case – they emphasise the need for fiscal stimulus rather than monetary (central bank) stimulus.

This being said, the below chart from Bianco Research shows the current utilisations of mandated Fed policy, the grey being the total allowable under current measures, the blue area the utilised limit – i.e. lots of ammo ready to be used if necessary. This ammo should be a stabilising force for US fixed income markets and USD bonds in general as FI volatility would be likely short-lived.

Source: Bianco Research

Credit

For the purpose of this missive, credit should be a distinct category to fixed income due to the exposure to taxation and corporate earnings discussions, which is less involved in pure “fixed income” government debt discussions.

Election jitters set a difficult and uncertain backdrop for corporate earnings and profitability, as US corporates or global corporates operating in US markets may see increased business uncertainty regarding US operations and possible tax changes.

Elevated volatility in US equities, FX and commodities historically coincides with wider credit spreads (lower credit bond prices).

While the election is a first-order issue for US-affected corporates, the primary issue they have is the path of the pandemic and outlook for US and global growth, regardless of the Presidency, with the stance of both fiscal and monetary policy for stabilisation.

FX

Regardless of the presidential election victor, the US dollar (USD) is fundamentally unsupported in the medium term, though US may rally around the election period in the event of a disputed election result. This is because the USD remains a well-regarded safe-haven and store of value.

The big differences between Trump and Biden that drive FX rates pertain to trade, tax and the environment.

Trump is more hawkish on trade in every respect and if re-elected, may impose more tariffs and further disrupt trade volume growth, investment and supply chains.

A resumption of trade wars from a 2nd Trump Administration may derail the recovery in global trade volumes since April/May this year, which has seen a rise in our AUD this year against non-commodity linked currencies. I suggest that given current momentum and positioning data this trend may continue as a function of medium term USD weakness.

Biden’s policies would infer lower volatility to global trade structures and be supportive of currencies that are strategic allies such as Europe and Japan.

Tax policy is the least likely affector for FX markets, as each candidate will likely need both houses of Congress to pass their tax policy, which is unlikely at present.

In terms of environmental policy, a Biden win is associated with more environmentally friendly policies and could take $10 off oil prices (USD per barrel).

If a lower oil price is realised, then there will be a lower inflation expectation in near-term CPI, all else remaining equal, and therefore higher real bond yields (adjusted for inflation).

Therefore, Biden’s energy policy in isolation is marginally USD positive. Elsewhere, Biden’s energy policies would likely see lower worth of Canadian dollars (CAD), Norwegian Krona (NOK) and possible Australian dollars (AUD).

Trump pursuing his stated energy policy could unleash the full potential of US coal, oil and natural gas capacity, resulting in a benign effect on USD ceteris paribus.

Closing remarks

If I can leave you with one clear idea, it is the clear theme that for financial markets, the Presidency is less consequential compared to which political parties have majorities in both houses of Congress.

One thing I’ve learnt over the years is that US Presidents have ability to steer the ship so to speak, but the goodship USA is colossal and the rudder is hard to turn, especially without Congress support.

Stable outlooks for fixed income, US equity and FX markets are most productive for capital allocations; and abrupt changes or periods of uncertainty are not supportive of economic growth and prosperity gains.

We should remain aware that the outcome of the election may not be known for days or weeks after November 3rd, and that there may be volatility if the majority of us are not aware. If we are all aware, it is less likely we see volatility ensue.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.