Investor interest in cryptocurrencies, both from institutions and investors, has exploded over the past six months. Although cryptocurrency has been an existing asset class for over a decade, its renewed public profile makes it important for investors to gain a holistic understanding of the entire industry before making an investment decision.

Following on from last week’s blockchain article, today we will delve into the world of cryptocurrencies – their features and use cases – with a special focus on the two largest by market capitalisation, Bitcoin and Ethereum.

As they are built on blockchains, cryptocurrencies will mostly share the following features:

- Transparency

- Immutable

- Decentralisation

Their use cases vary far and wide, providing the basis to facilitate transactions, provide financial services, validate legal contracts and to act as platforms to distribute and collect unique pieces of digital media (for example, digital artworks or videos).

Whilst many cryptos may serve similar purposes, they differ on the basis of what protocols they use on the blockchain, which can carry implications on their efficiency and usability, with there currently being 8,612 active cryptocurrencies (Coinmarketcap).

In the spirit of keeping things concise, we will focus on the five main uses cases which cryptocurrencies can have:

- Store of value

- Smart contracts

- International transactions

- Decentralised finance (DeFi)

- Non-Fungible Tokens (NFT)

Store of Value

The most widely publicised feature of cryptocurrencies is their potential to act as a store of value.

As defined by Investopedia, a store of value is an asset, commodity or currency which maintains its value without depreciating.

They can range from currencies (such as the U.S. dollar and the Japanese Yen), commodities (gold and silver), collectible items (Art) and treasury bonds of trusted governments (U.S. treasuries).

However, the strength of their store of value characteristics can vary from asset to asset. They are typically driven by extrinsic factors such as portability, supply and durability, as well as intrinsic factors such as investors trust in their position as a store of value.

As question marks have been raised over the activities of global central banks and their potential to promote inflation, cryptocurrencies with strong store of value characteristics have been driven to the forefront of investor minds.

This interest has primarily been around Bitcoin, which has been referred to as a “digital gold”, given its finite supply of 21 million coins, and its position as the pre-eminent cryptocurrency, taking approximately 60% of the market share. Despite its protocol being technically inferior to other cryptocurrencies in some respects, Bitcoin has been able to display strong store of value characteristics, given its position as the most well-known and trusted cryptocurrency. Whilst it has 5,000 years less history than gold and no fundamental value, the same essential premise exists – Bitcoin has value because people believe it should have value.

Smart contracts

Cryptocurrencies can also form the basis of smart contracts – which are self-executing contracts built on the blockchain, executed through lines of code. Smart contracts can automatically carry out the terms and conditions of contracts on the blockchain, saving time and removing the need for human input – something which Citi could have used to avoid their $900m transfer error.

They can provide transparency, accountability and accuracy across areas such as finance, real estate, insurance and even elections. Cryptocurrencies such as Ethereum, Cardano and Polkadot all provide an infrastructure on which people can generate their own smart contracts in the form of decentralised applications (dApps).

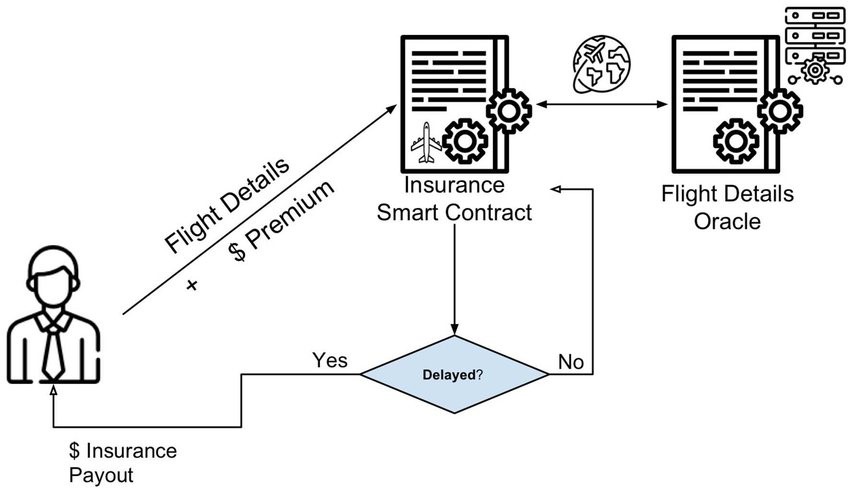

An example where a smart contract could be used is travel insurance. As displayed below, a traveller would upload their flight details into the smart contract and pay a premium to be granted the insurance cover. Terms and conditions would be outlined in the contract over what would deem a payout, with an oracle (third party service which uploads real world information into the blockchain) providing the relevant flight records. Should the flight be delayed, the client would then be paid out.

International transactions

Through the utilisation of blockchain technology, cryptocurrencies are able to operate 24/7 with relatively low fees on cross border settlements, having the potential to become a crucial component of international capital flows. Whilst Bitcoin and Ethereum have been touted for this potential role, stablecoins have led the way – which are cryptocurrencies pegged to an external asset (usually the USD).

Currently, USDT and other stablecoins are used for three primary purposes:

- Cross border transfers: particularly useful in countries with capital controls (like China and Argentina)

- E-commerce: negates international transaction surcharges

- Cryptocurrency markets: provides an asset which can be transferred between exchanges quickly

The scale of their use is reflected through their daily volume, with Tether (USDT) – a stablecoin pegged to the USD and largest in terms of market capitalisation, averaging $132bn in daily trading volume over the month of February.

Major corporations have also begun to dip their toes into the creation of their own stablecoins, with Facebook’s “Diem” (formerly known as Libra), and JP Morgan’s “JPM Coin” both receiving considerable investments from their parent companies as they attempt to create their own payments ecosystem.

Decentralised finance (DeFi)

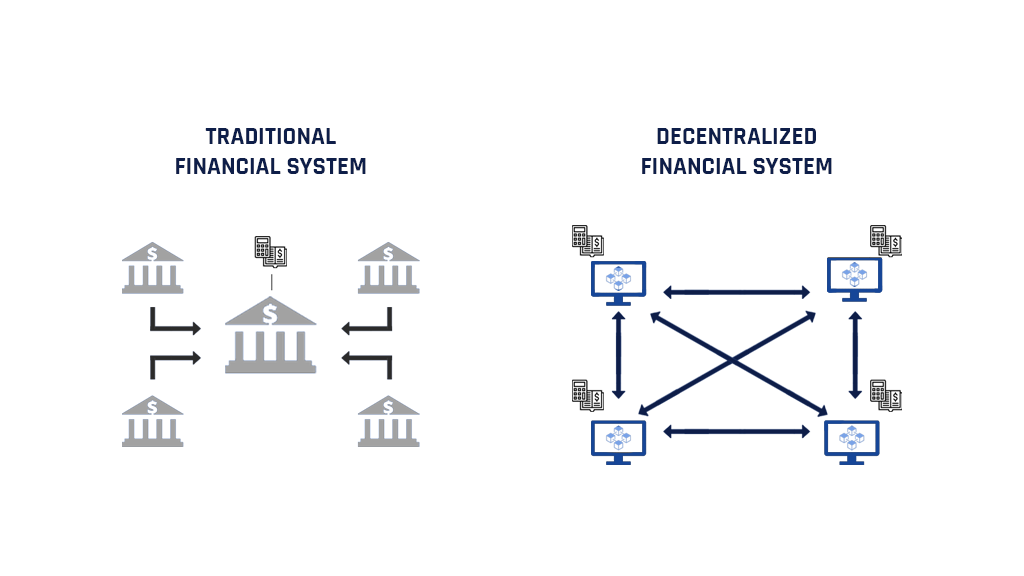

As the name suggests, decentralised finance (also known as DeFi) is an ecosystem built on the blockchain, providing financial services which are transparent, open source, and without a central authority. They rely on P2P interaction through utilising decentralised applications (dApps) and improve the efficiency of the current financial services industry through removing costly intermediaries and also removing the need for arbitration (should there be a dispute over the transaction). They provide essential financial services to the underbanked, allowing anyone with a phone and internet to participate.

Examples of current use cases for DeFi are:

- Borrowing and lending: cheaper, faster and reduced counterparty risk

- Decentralised exchanges: involves direct trades between individual wallets through smart contracts

- Insurance: individuals can both insure against risk and act as underwriters against certain events outlined in a smart contract. Pools are transparent and individuals can see their level of cover

The industry has seen rapid growth, with approximately $35bln locked up in collateral pools as at the end of February (DeFi Pulse), however there are still considerable roadblocks in place and many years of development required until DeFi becomes feasible for the masses.

Non-Fungible Tokens (NFT)

Cryptocurrencies can also take the form of art.

Yes – that isn’t a typo.

Non-Fungible Tokens are unique tokens which are not interchangeable (no two are the same), and usually comprise of a piece of digital art. They can take the form of avatars, paintings, video game collectibles and even videos, with one video of Lebron James fetching over $200,000. Whilst this video is readily available online, the NBA will only tokenise the video once, making the NFT a collector’s item (much like a game worn jersey). Unlike physical art, it can’t be forged, given the authenticity can be verified by looking at the blockchain.

Whilst it may be difficult to comprehend the prospect that physical art and collectibles could be supplanted by digital art, the space is growing, and is a sign of the increased digitisation of our world.

Bitcoin vs Ethereum

| Bitcoin (BTC) | Ethereum (ETH) | |

| Concept | Digital money | Smart contracts |

| Market Capitalisation (01/3/21, USD) | $45,424 | $1,428 |

| Supply | 21,000,000 total | No fixed supply, max 18m new ETH a year |

| Consensus mechanism | Proof of Work (PoW) | Proof of Stake (PoS) |

Bitcoin and Ethereum are the two leading cryptocurrencies by market capitalisation, making up 61% and 13% respectively. Despite being mentioned side by side, the two are quite different, having different purposes and characteristics.

Bitcoin was created as a form of digital money, intended to act as a medium of exchange and as a store of value (made possible by its fixed supply of 21mln coins).

Ethereum was created to act as a network on which smart contracts could be facilitated. The supply is not fixed, however new supply is capped at 18mln a year.

To simplify things a little, you could view Bitcoin as a form of digital gold, and Ethereum as the internet.

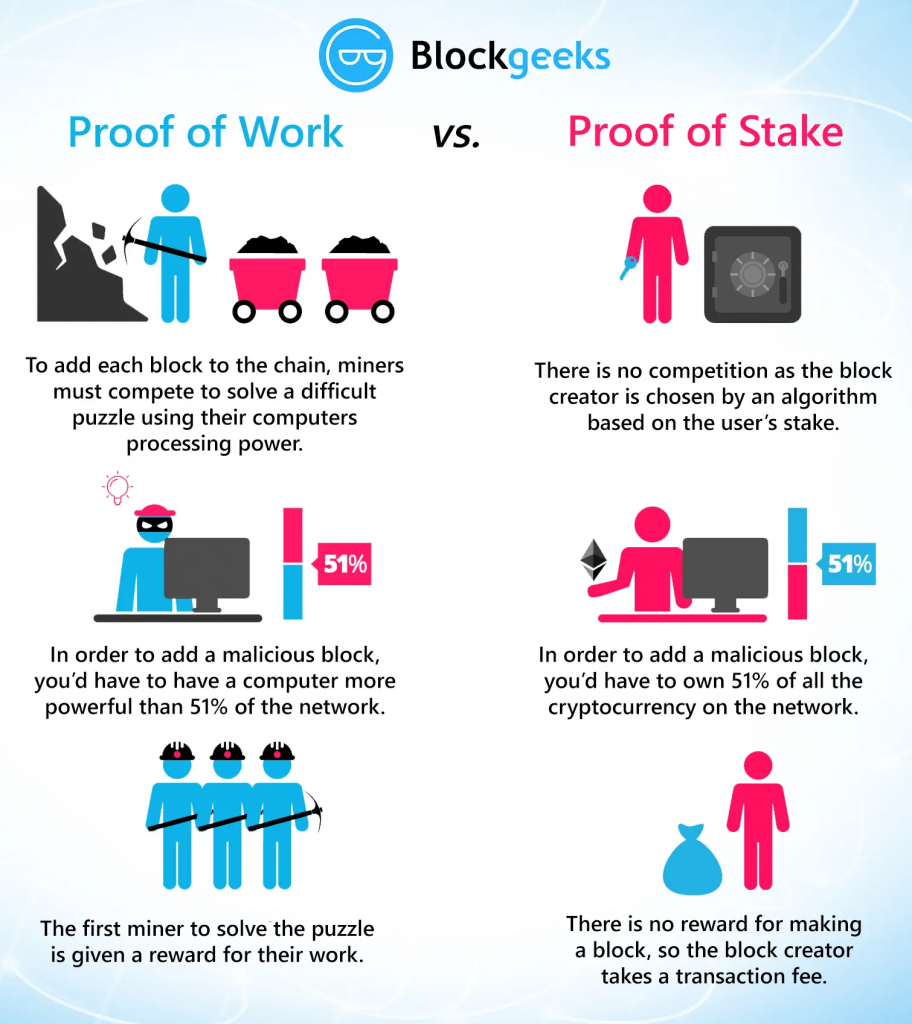

Both cryptocurrencies also differ on their consensus mechanism – which is the method by which a blockchain validates transactions.

Bitcoin operates on Proof of Work (PoW), which involves the calculation of complex algorithms, with miners competing against each other on the basis of computational power (i.e. who can solve the algorithm first). For more detail, refer to last week’s note.

Ethereum operates on Proof of Stake (PoS), which instead involves miners being allowed to mine or validate block transactions on the basis of how many coins they hold.

As you can see, the world of cryptocurrencies spreads across almost all facets of society.

They carry incredible potential to revolutionise the global economy, and provide more transparent, equitable and efficient outcomes.

At times they are complex, and given their relative infancy, valuations are largely driven by speculation.

As a result, it is important for investors to fully understand cryptocurrencies before they chose to invest.

Next week, we’ll go over what driven current valuations, and the evolving investment landscape.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.