There’s a lady who’s sure,

All that glitters is gold

And she’s buying a stairway to Heaven

Led Zepplin (1971)

Last Wednesday, I wrote this note about how central banks are providing so much liquidity in an attempt to calm markets, that it has had a degree of success in limiting market volatility since the March crash. Some equity markets like the NASDAQ are at all time highs, and others, like our ASX are well off the March lows, albeit still a circa 20% below their February highs.

I received quite a lot of feedback for this note – thank you – and I comment that this may be viewed as a bullish sentiment for me on financial markets under their current circumstances, despite being keenly aware that some valuations look stretched and we are in the middle of a global recession and multi-national pandemic.

I argue this isn’t a bullish narrative, more of a non-bearish narrative.

Please bear in mind that I was talking generally and there are many sectors and stock prices that have fallen dramatically and are still trading near their March lows. Sectors like energy, travel, tourism, property, infrastructure are still experiencing a bear market.

The advantage of the central bank liquidity, lower interest rates and a calmer bond market has had an initial impact of reduced volatility, tighter credit spreads, and a more ‘normal’ environment. Thus, enabling many companies to properly fund themselves at least in the short term.

Whether this continues or not remains to be seen.

However.

You know what is also hard?

Buying assets that you could argue are fundamentally and/or technically overvalued, despite not thinking they will go down in price.

This is market psychology and I think it’s as relevant to investing as any form of analysis is.

“I missed it.”

“I missed it” may be three of the most dangerous words in investor psychology, but also in life in general.

It’s the perception that you have an idea about something and that someone has already thought about it, or that what you imagined has already happened.

In investing, it’s pulling up a chart and seeing the asset price movement has already occurred.

It is an optical illusion of the human brain.

We see charts and when the line is at the top right corner, our psychology tells us the price can’t go higher as we’re at the top of the current drawn axis.

However, there are trading strategies that see this technical feature (chart analysis) as a ‘breakout’ or a buy signal, which can be expressed as ‘the trend is your friend’.

Whether the share price rally is justified fundamentally is tested when the company releases information on its performance and its expectations of future performance.

My AAPL anecdote

I worked for Telstra in 2006-2008 when the Apple iPhone was first released and was an early adopter of the new smartphone. I’ve since ditched the iPhone and been a loyal Samsung Galaxy user for years, but always stayed abreast of Apple’s technology, but also its listed equity (ticker: AAPL).

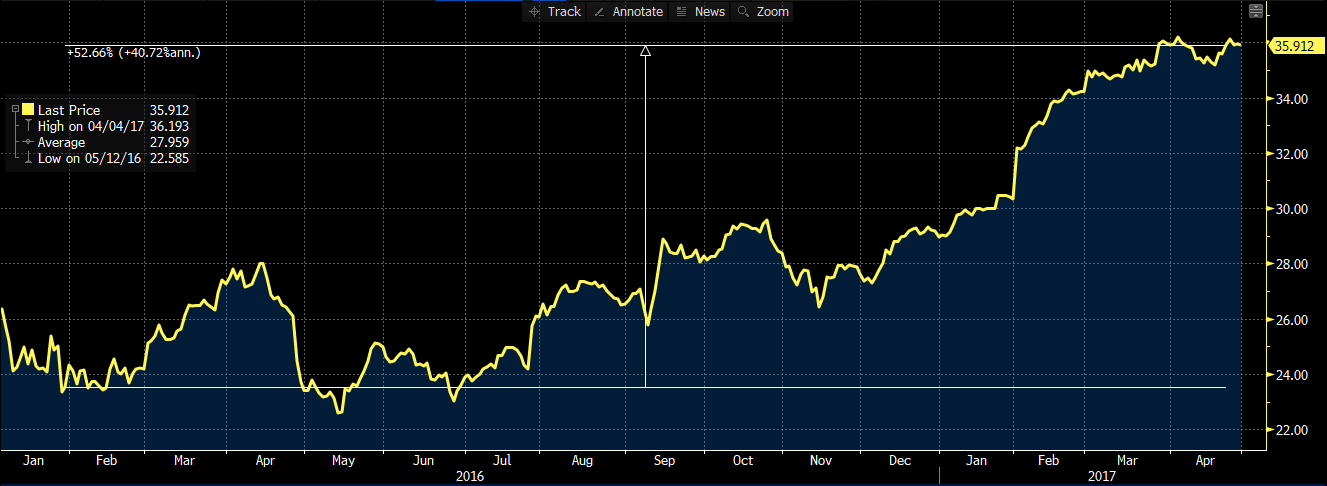

In 2016, after 10 years of iPhones, I thought AAPL was still a strong “buy”, but when I saw its price at $35 a share (+52%), I thought I was wrong.

I didn’t pull the trigger and buy some of the stock at that level.

Source: Bloomberg

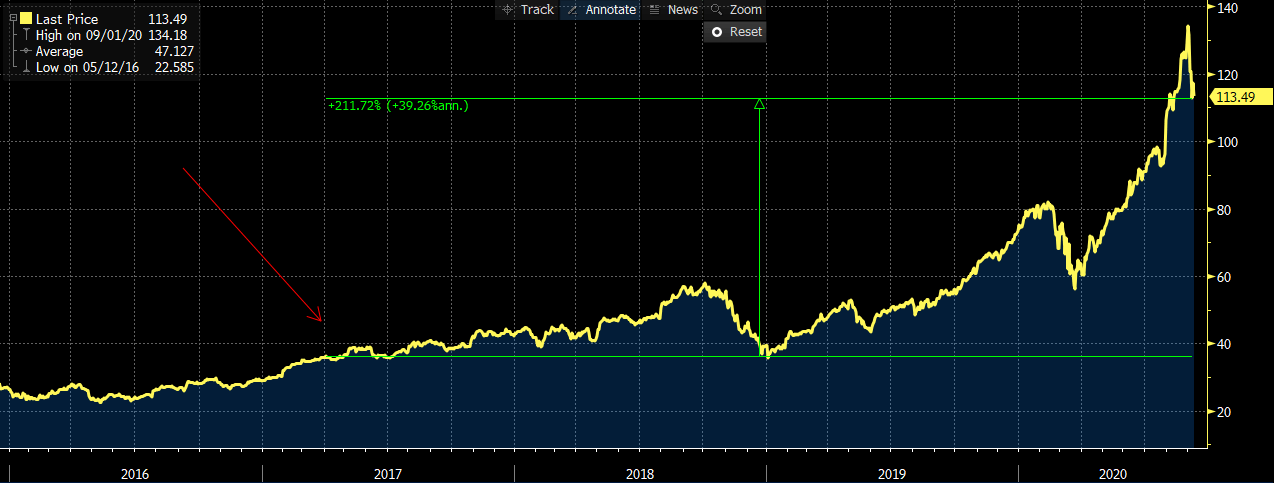

Let’s scale this out and see what the AAPL stock price has done since then – from $35 to $113, or +211%.

Source: Bloomberg

Trend following and inertia

According to Sir Isaac Newton, an object will stay at rest or stay in motion (i.e. maintain its course) unless acted on by an external force.

This inertia represents that objects continue in the direction that they’re going, until an external catalyst stops or hinders this trajectory or course of action.

In financial markets, securities exhibit inertia and continue in their trajectories unless acted upon by external catalysts.

Securities also have momentum.

We call this “trend following”.

i.e. Winners usually keep winning. Losers usually keep losing.

If you look at the first chart, I share of AAPL, you’d think you “missed it” but the trend for AAPL was not broken and AAPL has continued its momentum (with small breaks in momentum) over the last 5 years.

Rallies and selloffs

This also works for the short side of the market too.

If an asset price is heading downwards, it can continue this momentum and trajectory and keep going lower.

We have an expression for this, “Don’t catch a falling knife.”

Psychology and risk-management

Being in financial markets, we can access a lot of information to help make decisions.

I don’t think there’s any embarrassment in getting things wrong as long as we learn from them, just as I have no issue sharing my AAPL anecdote where I was plagued by self-doubt.

One such strategy for risk management is to use a stop loss, i.e. when we enter into an investment, we have a defined price where the original objective no longer makes sense considering market price movements and we decide to sell and take a loss. This doesn’t always work either, it is just one discipline that I personally like.

In my anecdote, if I bought AAPL in 2017 at $34 and it DID NOT continue to go up, I would sell-out of my position at a defined level.

Buy high and sell higher

Rod and I often comment that under current market circumstances, we find we must adopt a transformed version of “buy low, sell high”.

In some sectors, like technology or in US and European government bonds markets, it’s more like, “buy high, sell higher” right now.

We become more active in our portfolio management, we review objectives and prices more often – but also that we more clinically manage risk.

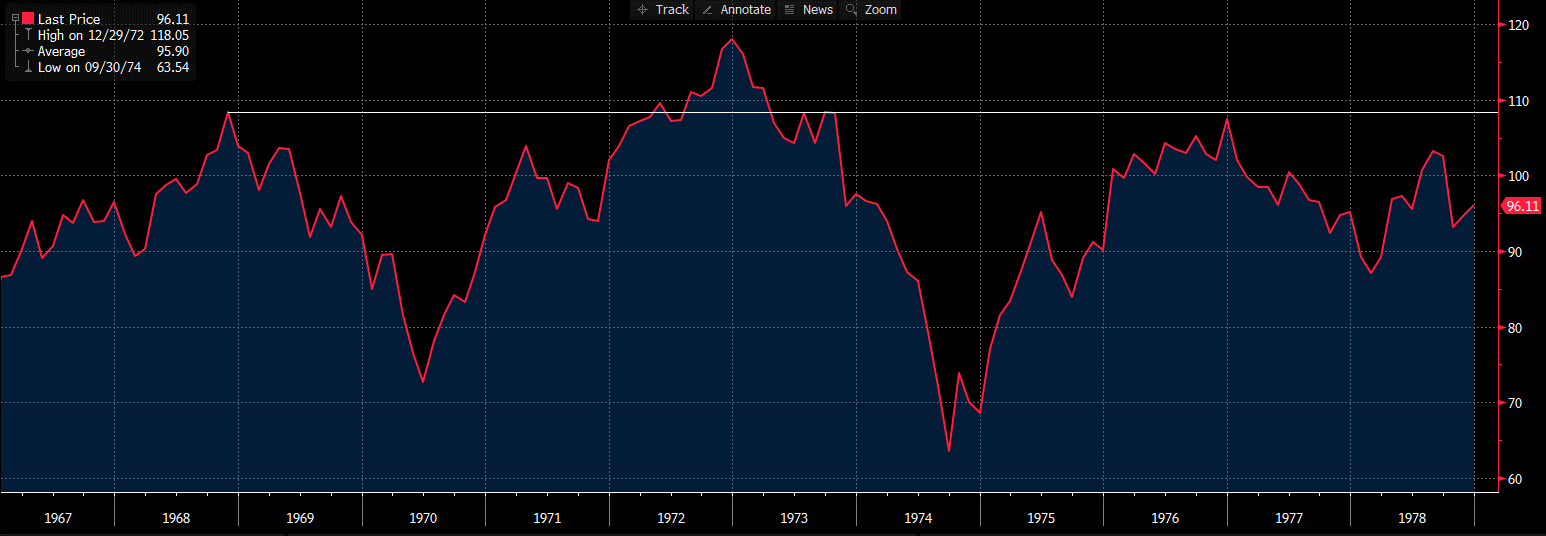

On 7 September we wrote about the analogues between 1968 and contemporary USA.

In doing so we mentioned that for the period 1968 to 1978 that the S&P 500 did not rise above the 108 level for any large period of time, and that equity market investors knew that everyone else knew that to make money in stocks one needed to TRADE them, not buy-and-hold.

Source: Bloomberg

Buy-and-hold works under periods of tranquillity and growth, although may not during turbulent periods where there are environmental ructions, social unrest, political events and clear socioeconomic winners and losers.

2020 has made us all review our ability to handle risk and adjust our risk tolerances.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.