“Funny the things you thought you’d never miss, in a world gone crazy as this”

Tim McGraw & Faith Hill (2014)

This may be new news – but financial markets around the world are in varying stages of transitionary periods to new interest rate benchmarks.

Existing benchmark or “reference rates” such as London Inter-bank Offered Rate (LIBOR) or the Australian Bank Bill Swap Rate (BBSW) are being used less and less, and regulators around the world have declared that alternatives rates must be developed and adopted.

The RBA – most notably Deputy Governor Guy Debelle – have commented on the lack of liquidity of one month BBSW (1m BBSW), saying that “users of 1-month BBSW should be preparing to use alternative benchmarks, this is particularly relevant to the securitisation and derivatives markets, which frequently reference the 1-month rate.”

Why the change?

Prior to 2008, LIBOR and similar benchmarks were seen to reflect the cost of unsecured borrowing between banks for a specific period – usually 1,2, 3, 6-month periods.

In the depth of the GFC, there was little to no inter-bank lending which meant most daily LIBOR submissions became based upon “expert judgement” rather than transactions.

As a rate, LIBOR was underpinning over $300 trillion USD of financial contracts and was vital to the function of the global financial system.

However, in 2012, the “LIBOR scandal” emerged (read: market participants were rigging/manipulating their submissions) which undermined the trust of the LIBOR submission process and undermined the trust in the efficacy and accuracy of LIBOR as a benchmark rate.

Move to risk-free rates

Globally, there is a movement to “risk-free rates” rather than “inter-bank rates”, along with other moves that these rates and benchmarks should be based upon financial market transactions, rather than judgement.

In Australia, ASIC has declared that the Australian Overnight Index Average (AONIA) is a significant financial benchmark in Australia.

AONIA is the daily effective overnight cash rate (currently 0.14% as at 16 June 2020).

I wish to make that distinction that the RBA Target cash rate is 0.25%, but the effective cash rate is 0.14%, where the market is trading below the RBA’s target level.

It is the unsecured overnight rate based on the weighted average interest rate used in unsecured transactions between AUD bank participants.

Over last twelve months, there was on average $3.3bio of daily transactions.

AONIA

You may ask how an unsecured rate is considered risk-free, or how we can interpolate an overnight rate to determine an AONIA yield curve.

These are good questions and I’m sceptical of AONIA for these two reasons.

Unsecured transactions between corporates such as Bank of QLD, Bendigo Bank, AMP, State Street Bank etc. all have inherent credit risk, regardless of the AONIA benchmark adequately pricing the credit risk. Therefore, the benchmark is never going to be “risk-free”.

I’ve had both regulators and debt security issuers tell me that because it is overnight, it is as close to risk-free as possible.

However, secured lending (collateralised lending) would be closer to risk-free.

Hence, the repurchase agreement (“Repo”) market – a secured lending agreement between two counter-parties as part of the overall Money Market (MM) – would be closer to risk-free, and there is a functional “term” repo market, which allows for a yield curve, as opposed to O/N compounding through AONIA…

I note, the USA went down this path of using repo rates (SOFR) as their LIBOR-substitute benchmark, as opposed to us in Australia who are copying the UK’s SONIA with our AONIA.

“Realised AONIA”

AONIA is essentially the daily compounding of the RBA overnight cash rate, with a weighted average applied to the transactional volume.

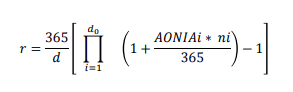

The formula is the same as the compound interest formula we learn in early high-school mathematics:

Source: Australian Stock Exchange

Therefore, AONIA has no forward-looking properties, it is historical – which is different to our current BBSW benchmark which factors future events into the yield/price.

AONIA is now being used

AONIA is starting to be utilised by debt issuers – with the South Australian Government Financing Authority (SAFA) issuing the first deal in May 2019 for $100mio AUD, a 1-year floating-rate note, referencing AONIA.

Second came CBA issuing AUD RMBS in November 2019 around $1bio in size.

SAFA have issued 3 new deals since their original, 250mio in Dec 2019, 660mio in April 2020 and 1.25bio last week in a 3-year FRN format.

For the recent deal, the rate was AONIA +34bp, which at current AONIA (0.14%) prices the first coupon at 0.48%.

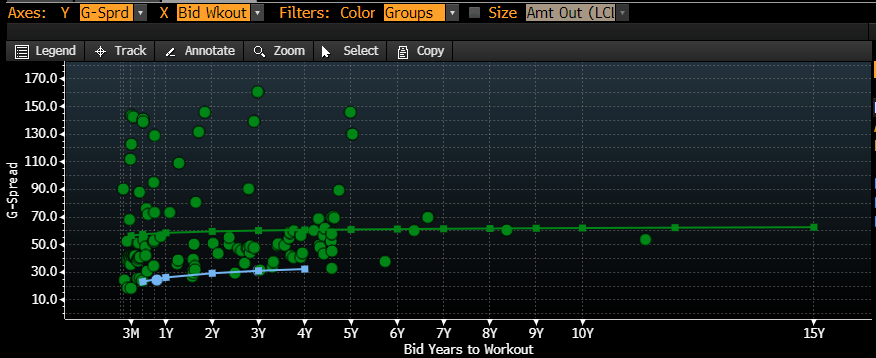

Below graphic shows GBP denominated SONIA-related deals in green, and AUD AONIA deals in blue.

Source: Bloomberg

Future Market Developments

The AONIA market is very new, and there will be a lengthy adoption process.

It becomes a chicken and egg scenario where bond issuers are hesitant to use AONIA where the investors are not urgently demanding the adoption of risk-free rates due to system development and system limitations.

However, it’s obvious the technology challenges are being dealt with as SAFA’s 100mio deal last year has grown to 1bio this year.

Likewise, market-makers are hesitant to produce new products that utilise AONIA, such as basis swaps, cross-currency swaps, interest rate swaps etc because there is little volume of trading AONIA and little debt being issued that needs to be hedged (if at all). These products now exist in the UK’s SONIA market, where SONIA-related deals are frequent and there is a wide array of products for speculation and hedging purposes on SONIA’s rate.

This will eventually come to the Australia AONIA market as well.

I’d recommend watching this space as it slowly develops, as we may see BBSW phased out altogether, which has implications for all our AUD FRNs and hybrids that are priced based upon BBSW rates.

In the meantime, prospectus and new debt issuances are issued with “fall back clauses” that assess the change from BBSW to “alternative” rates.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.