Ngilondoloze (Guard me)

Uhambe nami (walk with me)

Jersulame ikhaya lami (Jerusalem is my home)

Master KG [2020]

Today marks the vernal equinox so a happy first day of spring for all of us reading in the southern hemisphere. For those in the northern hemisphere, happy autumn!

This seasonal turning point demarks the last six months for me, as it’s approximately six months since COVID-19 was declared a pandemic on March 11th by the World Health Organisation (WHO).

I juxtapose the equinox with the song Jerusalema by Master KG – a viral gospel dance song from South Africa – because the song fills me with joy.

I first came across the composition scrolling Facebook and found a version I’m unsure how to share with you, showing children under 10 dancing with such merriment, despite the squalid conditions of the slum in Kitintale, Uganda they live in.

There are a few things in life that can shape your existence, and this was a catalyst for me, as I became immediately more optimistic and remembered small joys that have escaped me over these last 6 months.

Recent morning notes that I’ve written are about investor psychology and mental dexterity, which in review, I was writing just as much for me, as I was for you, my audience.

These last six months have taken a toll on us all – both physical and mental.

I believe today is a turning point that we can all use to exorcise our mental demons, where possible, and start spring with more joy in our lives.

Optimism in financial markets

Financial markets have tried to be optimistic regarding a recovery from COVID-19, most notably global equity markets.

The S&P 500 went through notable regimes where any vaccine news – even those highlighting delays to a possible vaccine – saw the market rally.

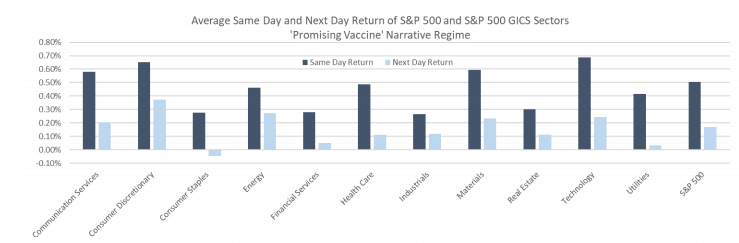

For example, news categorised as “promising” regarding a vaccine saw a broad-based rally across all industry sectors on that day (dark blue), between April and July.

Source: Epsilon Theory

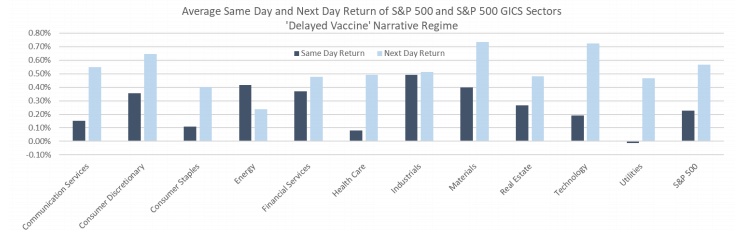

To compare, “delayed” results still produced a positive return for the market – just on the next business day (light blue), for the same time period.

Source: Epsilon Theory

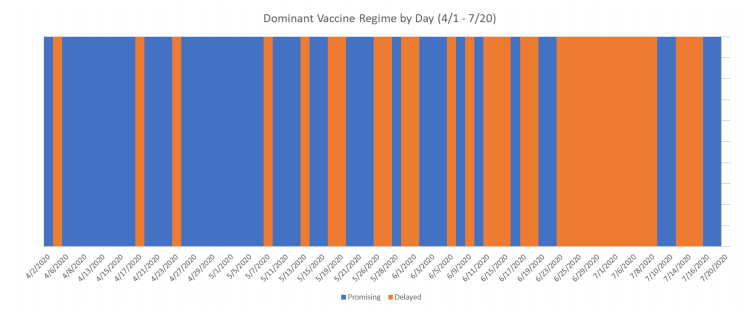

To depict these vaccine news regimes in another way – the blue sections represent a “promising” expectation for a vaccine, while the orange portions are “delays”, which happened more often as we realised that vaccines were not going to be developed in such short time frames as we hoped.

Source: Epsilon Theory

This trend has persisted since July until today, where our markets are buoyed by news of increased central bank intervention, fiscal expenditure, or vaccine news.

One other positive factor for Australia is that we’ve today entered spring and the start of our warmer months. Northern hemisphere countries are entering colder months and they may see an increase in COVID-19 cases and hospitalisations (and possibly deaths) as winter approaches.

Six months of COVID

| 29-Feb-20 | 18-Sep-20 | |||

| Price/Yield | Price/Yield | Difference | Change (%) | |

| AUD/USD | 0.6515 | 0.7321 | 0.0806 | 12% |

| AUD/GBP | 0.5079 | 0.5651 | 0.0572 | 11% |

| AUD/JPY | 70.36 | 76.73 | 6.37 | 9% |

| EUR/USD | 1.1 | 1.185 | 0.085 | 8% |

| Iron ore (USD) | 575 | 805 | 230 | 40% |

| WTI Oil | 44.76 | 41.15 | -3.61 | -8% |

| AU 3y gov bond | 0.50% | 0.24% | -0.26% | -52% |

| AU 10y gov bond | 0.80% | 0.88% | 0.08% | 10% |

| US 3y gov bond | 0.90% | 0.15% | -0.75% | -83% |

| US 10y gov bond | 1.14% | 0.68% | -0.46% | -40% |

| ASX 200 | 6441 | 5876 | -565 | -9% |

| S&P 500 | 2954 | 3357 | 403 | 14% |

| NASDAQ | 8567 | 10910 | 2343 | 27% |

| VIX | 40 | 26 | -14 | -35% |

| FTSE 100 | 6580 | 6049 | -531 | -8% |

| Gold (USD) | 1585 | 1952 | 367 | 23% |

Source: Bloomberg, Mason Stevens

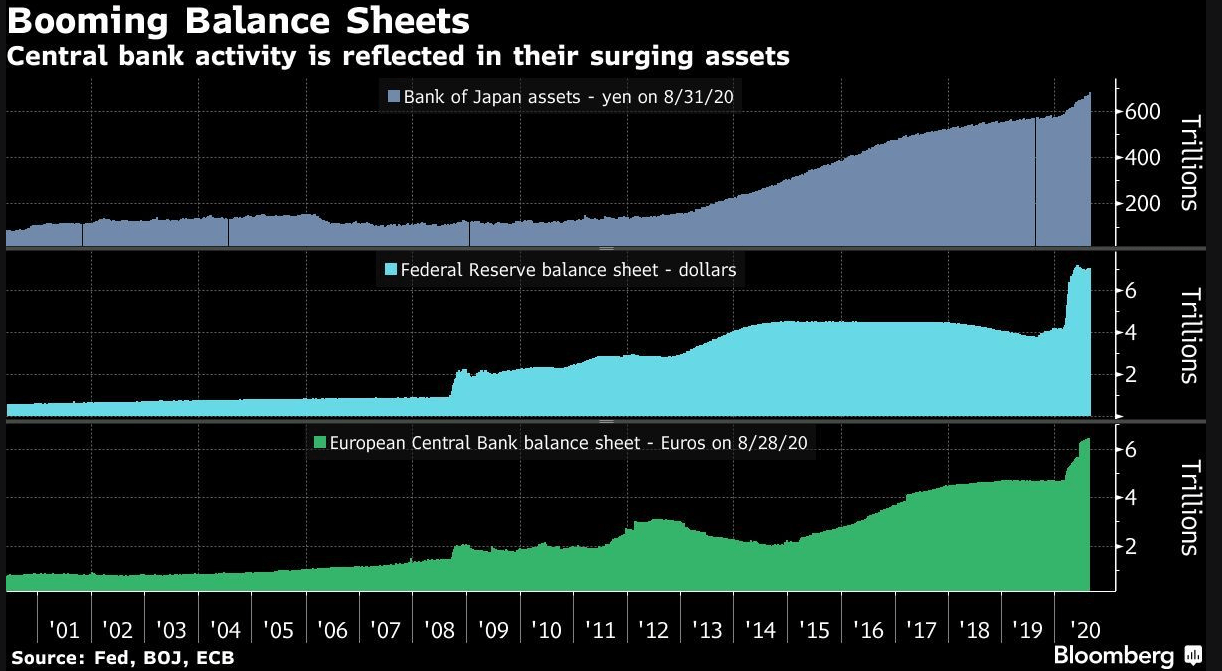

Central banks have cut interest rates 164 times in 147 days and committed $8.5 trillion USD of stimulus. The lion share of this was the European Central Bank (ECB) and the US Federal Reserve (Fed) with the Fed alone expanding its balance sheet from 4trn USD to 7trn USD in the last 6 months.

Central banks are discovering that monetary policies once viewed as unconventional and temporary are becoming conventional, widely used and long-lasting.

The below graphic shows that most central banks are diving deeper into these unconventional policies such as quantitative easing (QE) or financial asset purchases – defending their economies with more aggressive policy measures and the threat of deflation.

The US Federal Reserve, our RBA, the BoE and others are all practicing QE, some are cutting rates to more negative levels, such as the ECB at -0.5%, while our RBA has adopted Japanese-style “yield curve control” by pegging our 3y government bond yield at 0.25%.

Our AUD has been a strong performer during COVID.

Historically, our AUD’s strength is characterised by #1 interest rate differentials and #2 commodity flows.

At present we have higher government bond yields and a steeper yield curve which is a positive interest rate differential compared to other developed bond markets, but we have also seen commodity export volumes virtually unaffected by COVID, and a strong increase due to Chinese demand in Q2 where China’s economy “reopened” sooner than other nations.

Gold has also benefited from both commodities buying and safe-haven demand during this time. Gold is seen as a hedge on civil unrest due to its historical relationship with being convertable into physical cash.

Closing remarks

Financial markets continue to look forward, often optimistically, as markets forecast resumptions of normal corporate earnings, consumer spending, employment and near-term vaccine approvals.

These forecasts may need to be pushed back, but humans as a species show a large capacity to survive and grow from adversity.

In Berkshire Hathaway’s 55th AGM, Warren Buffett proudly said that “nothing can stop America when you get right down to it. Never bet against America”.

In his own fashion, Mr Buffett was espousing the view that humans are always improving the ways that we live and improving our quality of life. Because we’re consistently improving quality of life, it is hard to be pessimistic or negative on financial markets over long periods of time, as we seem to always return ourselves to prosperity.

Wishing you a prosperous and healthy spring – and the start of a better period.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.