The human brain is a funny thing.

There is a psychological phenomenon called the mere-exposure effect, a type of familiarity bias, where people tend to develop a preference for things merely because they are familiar to them.

In investing, this manifests in many ways where we invest to maintain overweight positions in domestic markets, and where we avoid allocations to countries or asset classes we know less about.

Two weeks ago I wrote a note about investing in Japan, as it’s the world’s third largest economy, has political stability, open and transparent financial markets, where their equity index (Nikkei 225) is up 88% these last 5 years.

Yet, it’s an exposure that is notably absent from most investment portfolios.

Today, we make the same argument for India.

Investing in India Thesis

India is the world’s fifth largest economy or ~7% of world GDP, behind Germany and larger than the UK and France.

Their 2019 GDP was 3 trillion USD, GDP $2k USD per capita, well below the global median, and their annualised GDP growth is 6-7%; very similar to China’s over the last 15 years.

Inflation (CPI) is stable at 3.2% (low for a fast-growing nation).

India has the world’s second largest population, around 1.4bln people, but it is a relatively young population. Unlikely China, India has yet to see the large wholesale migration from rural to urban areas, where their urban population is 35%, and China is 61%.

As a point of interest, there are more 11-year old children in India than there are people in Australia.

The drivers of growth in India are structural in nature, which suggests they are sustainable and likely to keep their trajectory on a steep gradient.

Structural factors include:

- Urbanisation of the world’s largest rural population

- Transition from an informal economy (90%) to a formalised one

- Young demographic with a median age worker of 27 years old

- Requiring strong investment in infrastructure to support urbanisation

- Ambitious government program to upskill 400 million Indians over the coming years

Oh and India’s major stock index, the Nifty Fifty, is up 113% these last 5 years, annualising 16.3% growth.

Disclosure Requirements

Similarly to other emerging market (EM) economies, the main headwind to onshore Indian investment is navigating the less transparent stock and bond markets, as well as dealing with the restrictions imposed on its currency, Indian Rupees (INR).

However, India is at an inflection point where the positive momentum has developed to address the lack of disclosure, or universal disclosure requirements for listed corporates.

As this momentum continues, more and more companies are releasing financial statements that provide transparent access to business fundamentals, so that risk and reward can be adequately assessed.

The reason for this positive momentum is that companies that were first to provide transparency to their balance sheets were rewarded with more capital backing from domestic and international investors, providing a competitive advantage and higher equity performance than peers. This ensured competitors quickly followed suit in order to keep up. As this rolls out across the nation, international investors are now at less disadvantage compared to on-the-ground analysts and local knowledge, benefitting international participation in India’s capital markets.

AUD/INR

India may represent a lesser known nation as less people have travelled to the nation and used their currency.

INR is a less traded foreign exchange currency, certainly compared to AUD/JPY or AUD/USD but is still liquid enough for investment.

INR is a mostly free floated currency, where its value is determined by a confluence of factors – such as inflation, interest rate differentials, public debt, currency account deficits and political stability.

Most of these factors have become more stable in recent years – with the exception of 2020 where most nations experienced higher than average COVID-19 induced turbulence – and the INR is more stable across a basket of currencies.

However, our AUD is still on an upwards trajectory relative to the INR currency because of our higher correlation to the global growth “reflation” narrative, and INR exposure is likely to be hedged by an AUD based investor.

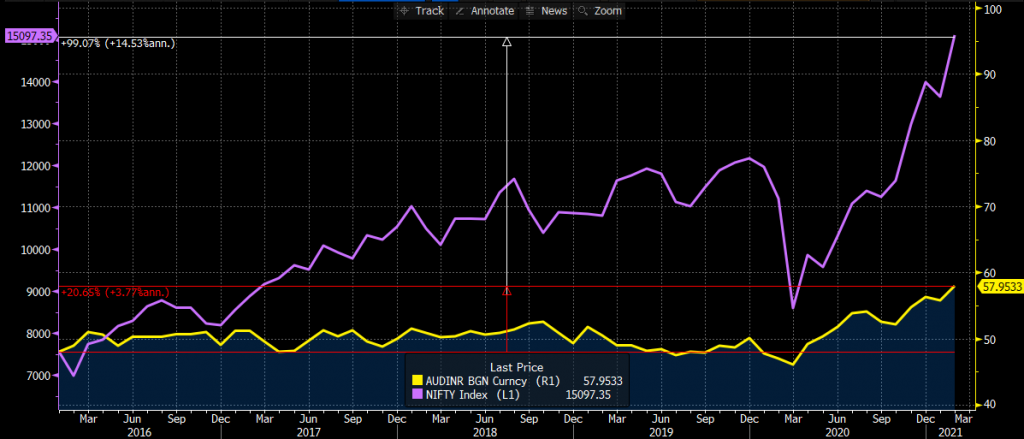

In the below chart, I compare AUD/INR (yellow) which has seen INR depreciate 3.8% p.a. against the AUD, whereas a broad Nifty 50 stock index investment appreciated 14.5% p.a. over the same 5-year period. Hence, investors would still have above 10.7% p.a. gains even without the currency hedge.

Trade Ideation

There is an increasing amount of ways to invest in India, as it’s a growing area of interest that is less correlated with developed market exposures, and slowly transitioning from an EM nation to eventually a DM nation.

In essence, it could be a way to achieve China-like growth for those that didn’t participate as readily in Chinese growth stories over the last 20 years.

Two lower cost investments are ETFs listed in 2018:

ETFS Reliance India Nifty 50 ETF (ASX: NDIA), which aims to track the Indian National Stock Exchange (NSE) inclusive of India’s 50 largest companies (“Nifty Fifty”), the equivalent of the ASX 200. The Nifty Fifty is about 2/3 of the Indian stock exchange by value.

Such an investment can be used for both long-term (strategic) allocations to the Indian growth story, or as a way to overweight Indian market exposure relevant to broader EM allocation.

Betashares Indian Quality ETF (ASX: IIND), which provides exposure to 30 Indian companies based on profitability, leverage and earnings stability. This is effectively a smart-beta strategy, using factor ranks to exploit potential inefficiencies in Indian equities compared to a traditional capitalisation weighted approach.

If you’re not a native AUD investor, there are several international versions available such as:

- WisdomTree India Earnings ETF (NYSE: EPI)

- Invesco India Portfolio (NYSE: PIN)

- iShares Nifty 50 Index Fund (Nasdaq: INDY)

- Market Vectors India Small Cap Index (NYSE: SCIF)

There are also more and more managed funds that are available for investment, for those wanting more actively managed positions.

Examples of these are the Ellerston India Fund, India Avenue Equity Fund and the Fidelity India Fund.

American Depository Receipts (ADR)

There are also many direct ways to gain exposure to Indian growth through ADR investment and are useful for those less inclined to use managed funds or ETFs.

Many investors will be familiar with ADRs, utilising the NASDAQ listing of Alibaba group (Nasdaq: BABA) instead of participating in the Hong Kong listing (HK: 9988).

Examples of these are:

- Tata Motors Limited (NYSE: TTM)

- ICICI Bank (NYSE: IBN)

- Infosys (Nasdaq: INFY)

- Rediff.com (Nasdaq: REDF)

Closing Remarks

India represents a unique and rare opportunity as it has a different growth profile than developed market opportunities – where demographics, public indebtedness and inflation/deflation are all positive to the Indian economic growth trajectory, and where their young workforce are earning higher wages, velocity of money is increasing.

The major inhibitor to foreign investment has been longer-term political stability and financial statement disclosure, both are improving over time.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.